The world of business has changed; it grows online on tech soil. Checks and cash have been there for decades — outdated, expensive, and slow. But not anymore. With remote work and hundreds of subscription services, we're now working a 10-times faster, so our finance systems should too.

Here's a thing: imagine you could issue hundreds of cards instantly, track them in real time and control your spending like never before. Well, you can — you'll need to get rid of your plastic.

The future belongs to virtual cards, the most convenient digital e-payment tool leading to a massive jump in business. Finally, it looks like something you want to use, not something you are forced to deal with. But, with so many options out there, where to begin?

What's a virtual card exactly?

A virtual card for business is just like a credit card — except you don't have to carry it around. It has all the details like a physical card, including a card number, expiry dates, a CVC2 or CVV code, the cardholder's name, and billing address. So, it's just like a Visa or Mastercard but tailored for marketing needs and way more convenient and secure for online transactions. Virtual cards are a relative innovation that provides your teammates with level-up cards issued for specific vendors or categories, with daily, weekly or monthly limits you set by your own rules. And, finally, they offer cards for each employee — with no bank calls, just in a couple of clicks.

What's wrong with a same old company card?

Simple fact: physical cards just don't fit business right. They're merely a new way of paying for purchases with the same old stick-in-the-past card technology, which means many problems. They're not safe, too long to wait (oh, another 3-5 days on the row), you can't issue as many cards as you need, and forget about any flexible limits — no vendor, category, time, and period limitations, and no expense control. Too many 'no.'

But that's not all. With physical cards and funding tied with the bank account, prepare yourself for inevitable overspending — also, no chances to make a one-time purchase. As a result, many services are paid by one card, so bookkeeping becomes a total mess.

Dealing with traditional bank system for business always becomes you vs. them

Types of virtual cards for business

All the cards seem similar, but not all of them are right for business. That's because the pros and cons of each type of virtual card differ:

One-time payment cards

They have a fixed amount of money loaded on them and will be disposed of once you spend it. Since these cards were designed as gift cards, they're the least flexible for business use as they can't be reloaded or refunded.

Vendor cards

Virtual cards for every vendor company use and limit available funds. Card limits reset each month, so it's easy to track vendor payments and not get charged extra either. Also, there's no need to wait for a check or an ACH payment, so it's fast, secure, and works perfectly with card processing workflow.

Category cards

They dedicated virtual cards to a specific category or subscription. With them, you can better track, manage or freeze spending within the category you chose.

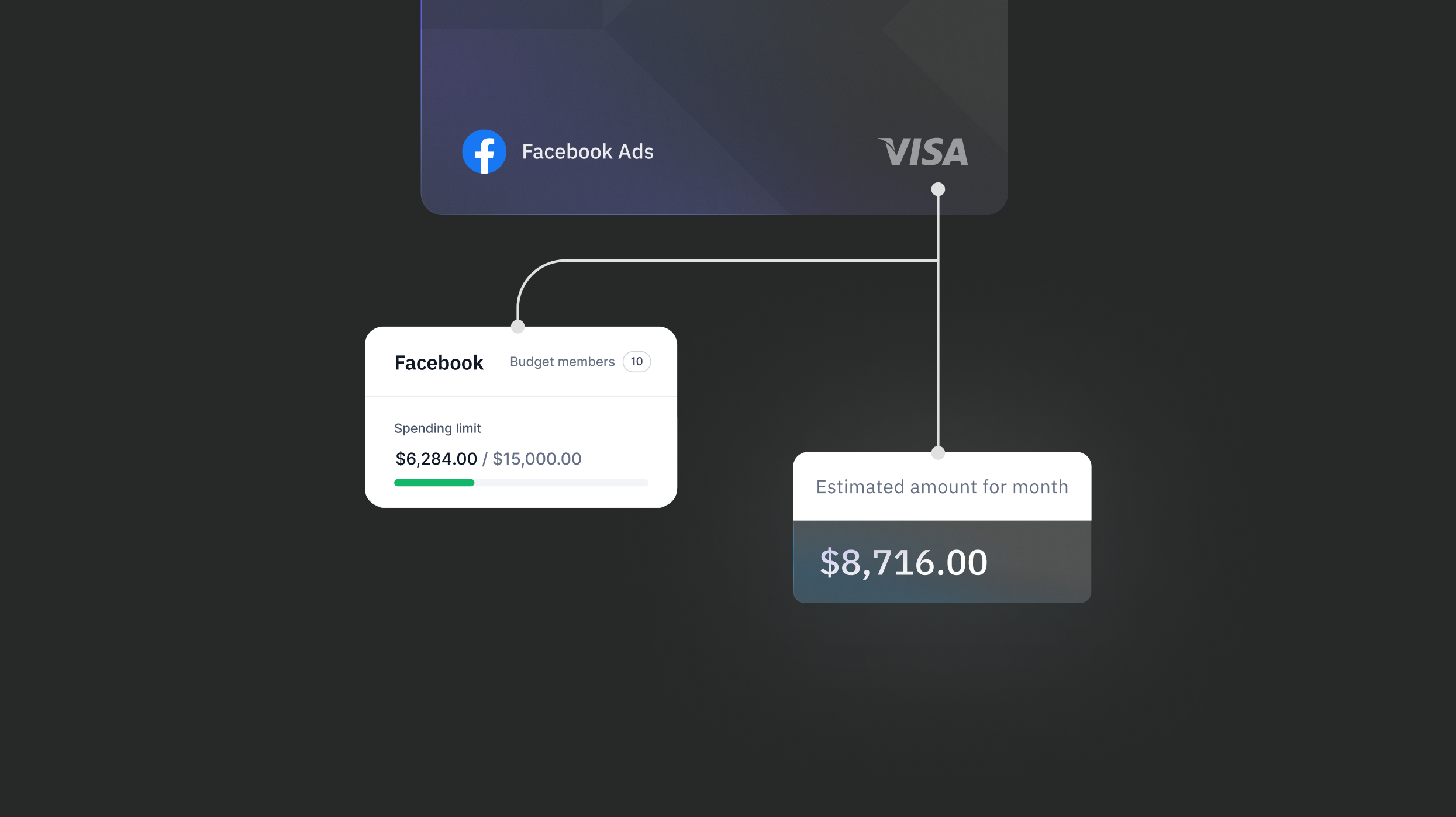

Virtual cards connected to the budget

A new way to pay that's flexible, versatile, and easy to use. In the modern world of finance solutions, you can set a specific budget, spend category, and vendors to allow, add employees and let them issue the cards within the limits you set to reduce the risk of overspending.

How do virtual cards work?

In short, a virtual card business allows you to get to the "checkout" step of any online payment. You still hold the exact details on a plastic card, but copy/paste details, just as if you use a plastic card. Virtual cards provide convenient online purchases, also occasional ones: office supplies, for sure, event participation fees, etc. Even offline purchases via your Apple Pay or Google Pay — it's like a virtual digital wallet in your pocket.It's a top-notch solution for advertising; pay for Facebook, TikTok, Google Ads, Taboola, and others. You can save time and get the most out of your digital advertising to reach more customers.

Looking forward: virtual cards for the future

The business virtual card might be the most significant thing for online spending. It helps you get a better picture of your finances and replace time-wasting manual work with huge benefits. Such as?

Optimized and streamlined accounting workflows

A digital virtual card eliminates waiting for your team's sweet checks to arrive. You replace the cumbersome and error-prone manual accounting with a secure automated tool. Review expenses in real time, so you can close the books in half the time and avoid the mess at the end of the month.

Payment happens immediately instead of taking days, giving you and your team real-time visibility on your cash flow data so you're better informed with budget decisions going forward. Also, you put transaction limits to avoid surprise fees or zombie spending and simplify vendor management.

Increased security and fraud prevention

Virtual cards for business assist you with a better security level than a traditional card. Here's why:

A virtual card isn't physical; it can't be stolen or left at the bar.

If you fear your card information may be compromised, you can instantly freeze or delete the card and request a new one to be generated in one click. With physical cards, it takes 3-5 days to reissue one.

Personal information is never stored. In contrast, the traditional system is risky, prone to data breaches, and can compromise your security.

Flexible spending limits help to prevent overcharges, protect against fraud and ensure you stay within budget.

Creating virtual cards is a wise decision to reach better security in the digital payments metaverse.

Improved spend control

Keeping track of expenses is a crucial part of business, but it's also time-consuming and frustrating. Virtual cards make it easy to onboard your staff and contractors. Request the card, add a spending limit, choose the date it ends, and decide if you want to restrict its use. Create multiple virtual cards, connect, set the budget and spend rules to track different subscriptions, vendors, and tasks. You can see the virtual card from the team makes its magic with no extra actions.

KARTA makes a massive leap in automation

Virtual cards are skyrocketing in popularity, and that's wholly deserved: they offer improved security, seamless integration, greater flexibility, and spend control that cuts you off a manual mess. All the things we hold much-esteemed in KARTA — with virtual cards for business unlocking access to a new level of control while saving you money in the long run.

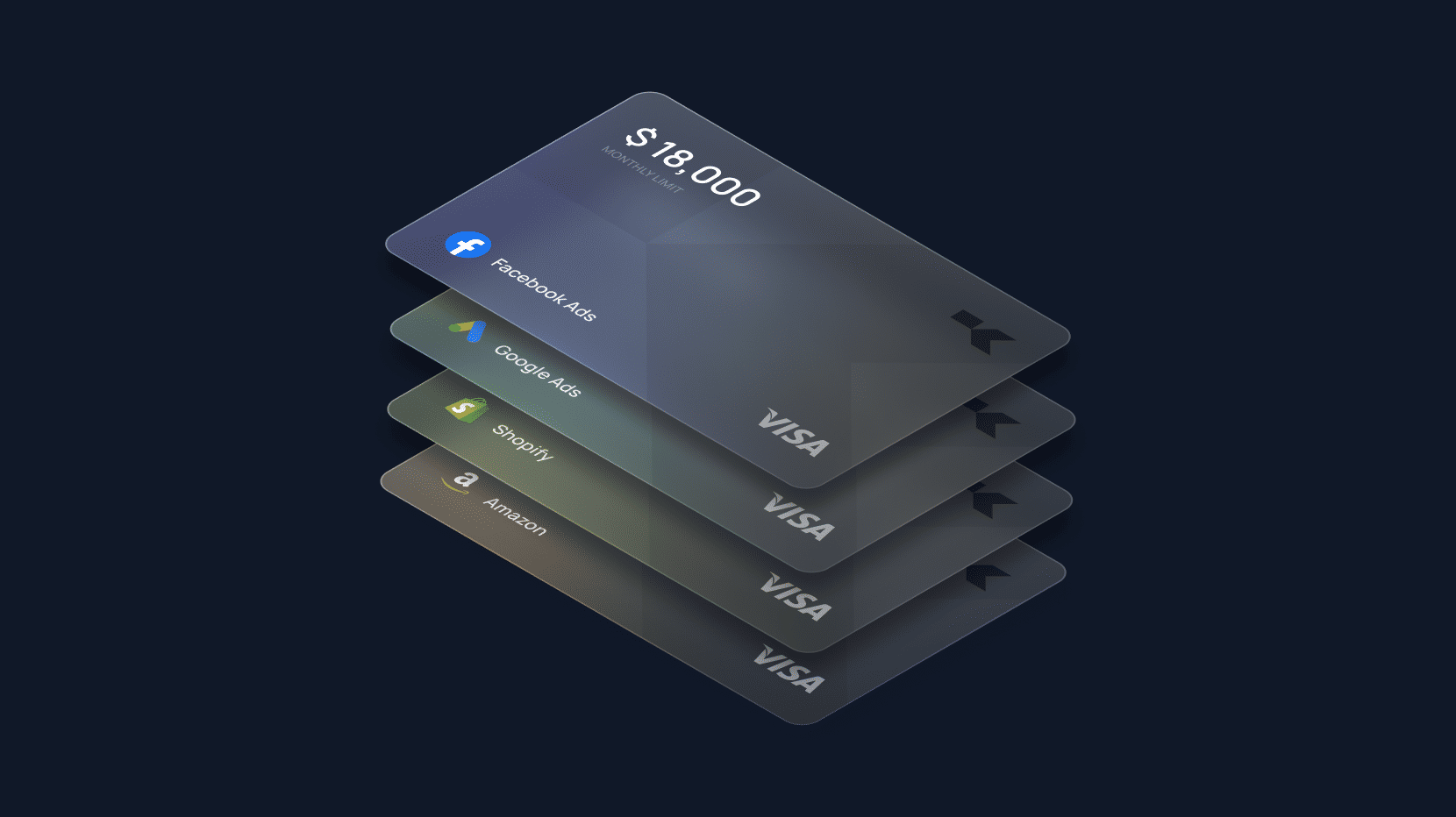

More about cardsMultiple cards to superpower your business

There are no limits on the number of cards you can issue — get any cards for any task and scale faster.

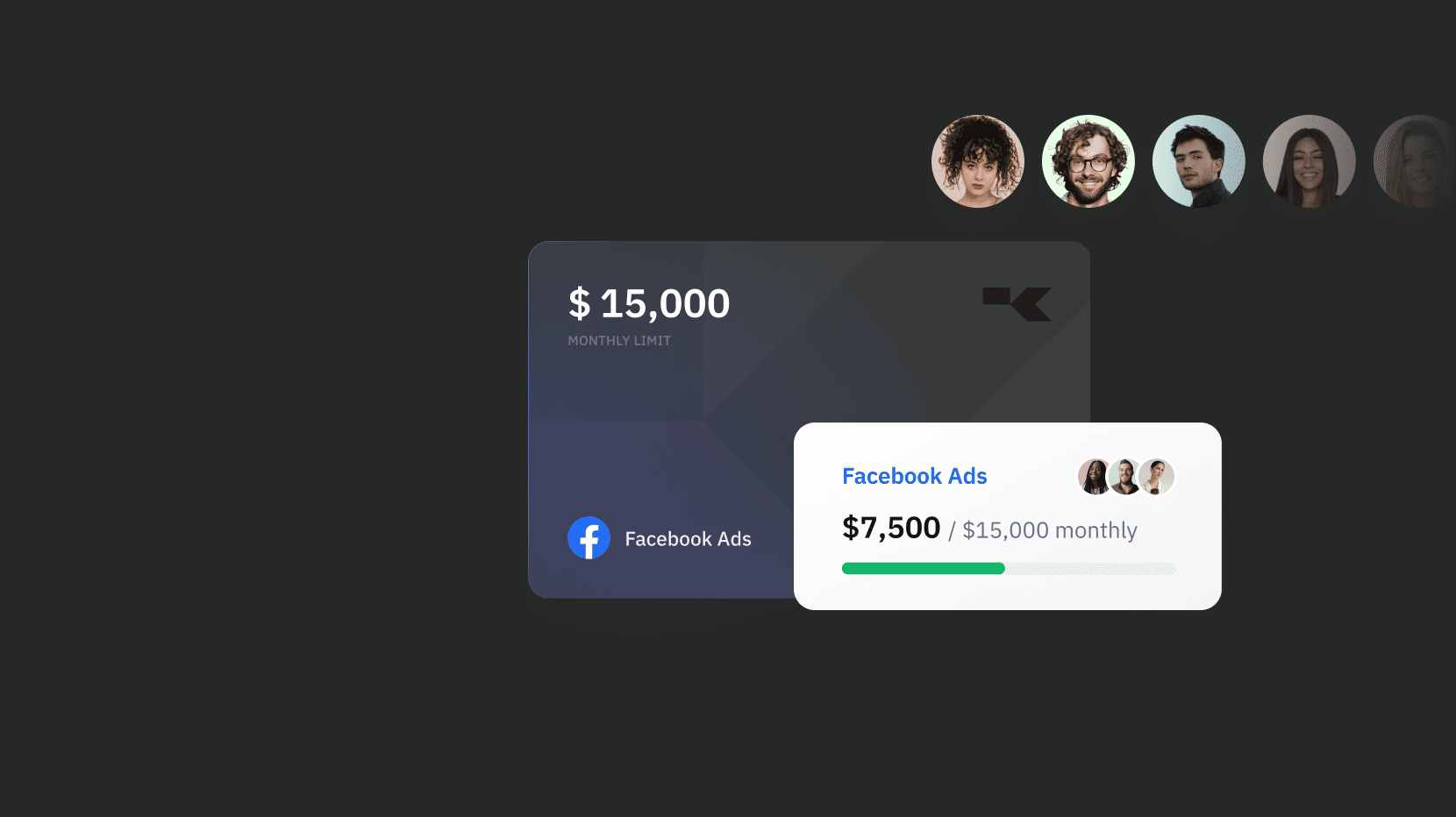

Set limits to reach unlimited possibilities

Define spending rules for every user, make budgets, control expenses and easily track them — no overspending on the way.

Quickly freeze or block a card

In a few clicks, with no calls for support service.

Unlock the power of Budgets

The newest and easiest way to get all your teams together. Inside one place, with real-time updates. Simple.

Advertise on a large scale

With multiple virtual cards, you can quickly pay for Facebook, TikTok, Google Ads, Taboola, etc. Scale successful campaigns and reach more customers.

No fraud, just full protection

Safety first, always. Keep your money secure with no fear of being scammed. Issue a single-use virtual card that's perfect for online payments. Our virtual cards allow you to eliminate the hassle of printing out receipts and filing expense reports.

You'll have real-time visibility into every transaction — as it happens. So you'll never go back to the pre-KARTA days.