The way how, why, and when money spends at work is critical — it can spell the difference between growth and failure. A constant battle over priorities and direction gets worse, and modern organizations keep playing a blame game over corporate spend categories.

It has to be stopped. Messy spending costs companies millions of dollars. Employees do not take responsibility for their actions and often do not even consider their actions' effect. Rules are not enough; you must instill a culture of responsibility among employees by making it easy to follow the rules. Deep diagnostics, convenient solutions, and ideological work with employees are the solution.

Why it matters for your team

Today, with a tendency to take high responsibility for day-to-day decisions, employees expect to be more trusted and independent. Rather than follow a tedious and time-consuming expense approval process, they need to spend autonomously — while the finance team still stays in control. Without this spending culture foundation, companies' financial well-being is not sturdy.

It's just like maintaining a healthy diet. Spend culture means a radical, automation-forward rethinking of your daily menu. You need to be sure that every employee, from finance to marketing, acts in the company's interest, empowered with the secret strategy ingredient — the freedom to make the right financial decisions that lead to substantial business growth.

An accurate picture of today's spending culture: it's out of the rage

Currently, spend management culture drops into two camps. The team acts freely with no actual limits and pays for mistakes later, trying to fix complications in tracking company expenses. Or keep frozen by endless permission for funds to progress their daily tasks.

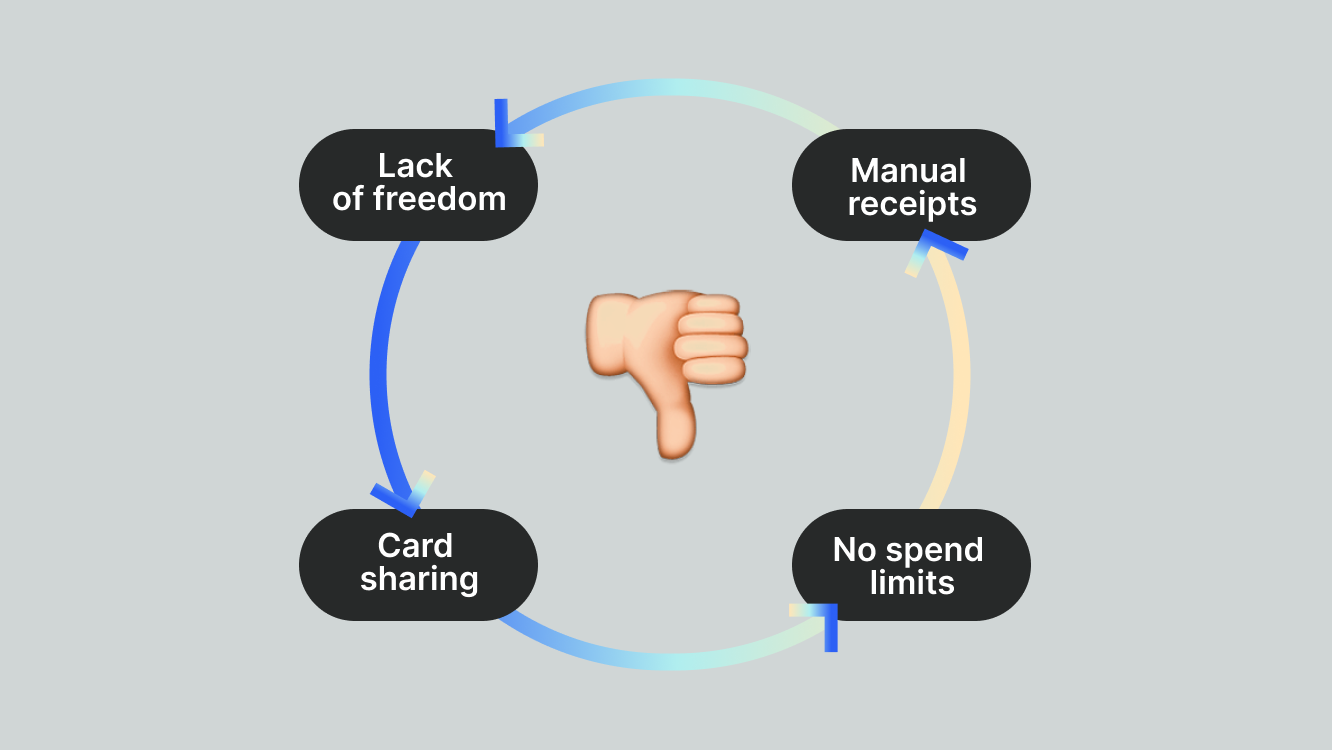

In both ways, expense policies are cluttered with static documents no one views, rising tension between employees and management. The result is, that you're grappling with many issues:

Sharing company cards isn't worth the hassle

Ugh, a bad idea. Card sharing raises misunderstandings about what should or shouldn't have been purchased, as memory fails. No one remembers an unexpected expense that arose a week before. They're forever forgotten, and you thought you had more than you actually did.

Reviews are costly and slow

Manual receipts, lots of signing, and approving processes on a plate. Asking your employees for data is like putting your expenses on a hard mode — complex and time-wasting.

The lack of visibility

Books closing is the only chance to see it clearly. While expenses happen on different cards, invoices, reimbursements, etc., it's impossible to tell how much a team spent on and offsite. When there's time to focus, you have no clue how much your team spent overall.

The more you rely on this outdated process, the worse managing spending is — putting your team into a monthly closing a nightmare, spending days on tasks that should only take minutes. And these aren't simple and fun.

What is in store for teams?

According to Deloitte forecast, the role of finance teams will be shifted from budgeting to advanced planning.

It should be a partnership and collaboration between the parties, contributing to company operational effectiveness and growth. Finance workers must be liberated to focus on more creative problem-solving in the future. Employees need to be equipped with the right spending policy and software platform, feel trusted to manage to spend, have greater satisfaction in their roles, and raise their performance game.Thanks to advanced and flexible business spend management solutions, companies can now make decisions and track their spending within minutes of purchase while still allowing them to operate how they want to.

A new way: freedom within a budget

While some spend culture implementations are high-stress, people-focused nightmares, others have nary a ruffle in their feathers. What does that happy medium look like?

The critical element of the right spending culture is easy (and safe) access to company funds for spenders but within a budget. When all payments are transparent, and you can easily set bespoke limits, getting real-time insight into company spending, there are fewer surprises, and business spending management is more superficial. In this case, employees are guided by cultural norms and encouraged to do the right thing. And this is what positive financial behaviour looks like.

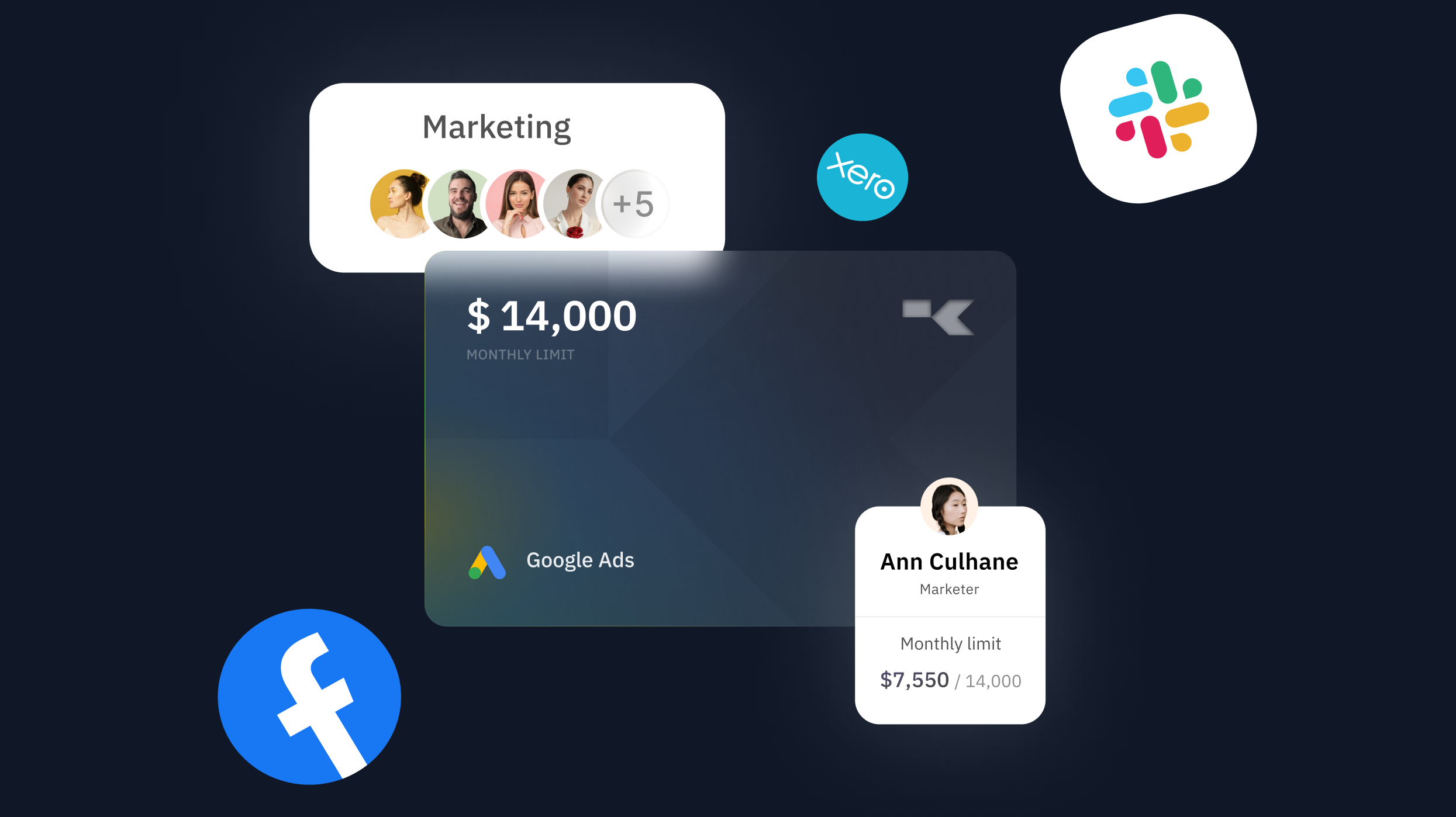

But it's not just about employee trust but also empowering them with multiple virtual cards so they can issue all the cards they need to spend on advertising, development, or office staff without the unnecessary approval processes.

Unlimited virtual cards for business

Every employee can create as many cards as needed, set limits, and always stay within budget — with no fear to overspend.

Learn moreBest practices to build a modern healthy spending culture

In a culture of massive spending, the moment has come for businesses to adopt technological solutions in managing to spend. Modern innovative tools make such movements viable for companies — and today, there's room to train healthier spending habits.

Create multiple cards for specific tasks

Allow your team members to get all the cards they need in just one click — for any purchase. Your employees feel trusted to act on their own and more valued for their knowledge and experience. As a result, they are more engaged in their work and motivated to spend money responsibly.

Spend and track — all in one account

Instead of many stand-alone SaaS subscriptions for every department, use a single tool to manage all expenses, which helps easily track them. Your team members clearly understand a company's enterprise spend management rules and values and follow them like experts.

Set limits and define access rights

Decide how much money to put on. Set a daily, weekly, or monthly budget, so if someone gets ahold of it, there's no spare money to overspend. Automated solutions help team members spend money consciously, with no fear of turning against them.

As a result, your finance team will be able to more easily trust expense claims based on reliable, intelligent, and verifiable information. When there's mutual trust, culture is strengthened.

Technology has its limitations, but it can be a powerful tool for connection.

The right spend management software can make a difference

At Karta, we solve the most prominent pain points of creating a healthy spending culture by replacing outdated technology with the new one that contributes to its success. The Karta helps:

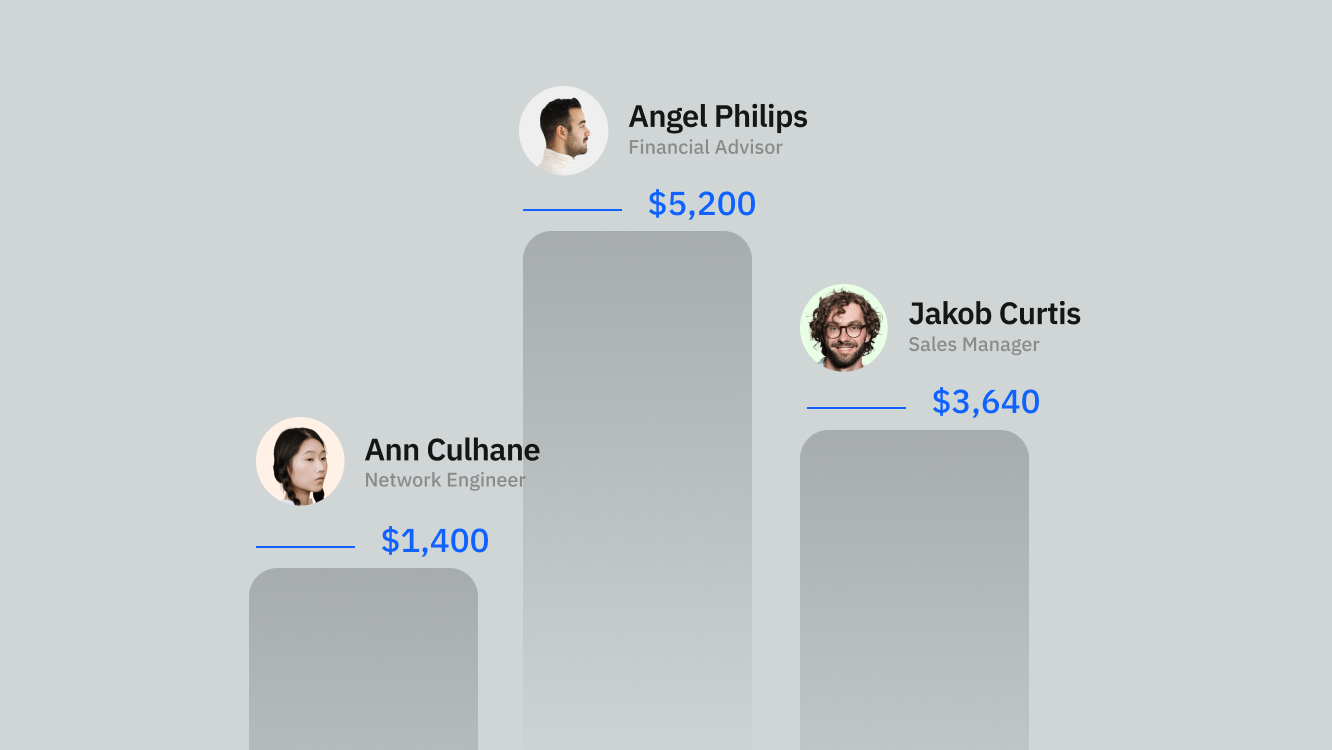

Enable a "trust and verify" model at scale

You can create and manage budgets for each employee, team, and department. Budgets have clearly defined expense policies so employees know what can be spent under each budget without seeking approval on every expense. And no overspending.

Check budgetsSave time on bookkeeping

Sync expense data with ease through the system to automate reconciliation. Close your books right on time, without the effort — it now takes about an hour a month.

Get real-time visibility

Karta allows track spending in real-time, giving an up-to-date picture of who is making each purchase across the entire organization, reducing the number of reviews for managers.

Growing a company is about more than just the revenue you are generating. Healthy spending habits are what allow you to scale your revenue and profit in the future. When you have a healthy spend culture you will never have to fight fires because of irresponsible overspending. Instead, your team will be on the same page, following your vision and delivering positive financial results month after month.

With an all-at-once solution, you can move and grow faster, meeting your financial needs. We enable a culture of trust and financial discipline at scale, speeding up business, so you can easily spend, scale, and enjoy the ride.