It can be your best friend or your worst nightmare. It all depends on who's running the numbers. If a business expense tracking spreadsheet is handled and monitored correctly, it can save you more time and money than they save by creating inefficiencies that lead to bottlenecks.

Sure, spreadsheets for small businesses are good for doling out dollars and cents, but as your business grows, you have much more to worry about than just accounting.

Think about things like scheduling, tracking expenses, calculating time worked, staying on top of project costs, managing vendors, and much more — doesn't it make sense to consider using an expense management software that can handle all of this for you?

It's time to jump.

10 reasons to quit using spreadsheets

1. Spreadsheets are not user-friendly

Yes, we all know them, and they're customizable, but spreadsheets can be tedious when you have a lot of data to input. You know the drill: tax spreadsheet for small businesses is challenging to eat and digest.

2. Security is off

Spreadsheets are standard for storing and analyzing data, but unscrupulous employees can also misuse them. Spreadsheet creators can easily create fake receipts and share them with the world, or they can create them and send them to their competitors to steal your customers. As the spreadsheet “spread,” so did the number of cropped-up errors.

3. Who edited this Excel document? Hell knows.

Collaboration is critical to success, but when it comes to expense sheets for business, it's hard to tell who edited a cell. Try to indicate a party if an error happens and there's no way to find it. Salespeople hate working from spreadsheets because divvy leads and customers take a lot of work. Without proper documentation, your sales team will be flying blind regarding their outreach efforts.

4. The truth is out there

When everyone works from the same business expense sheets, the opportunities for confusion and errors increase. One person makes a change, then uploads it to the master copy — but what if they forget to upload it? Now you have multiple versions of the database to go over, and the sales process gets cluttered.

5. Manual error, you're welcome

There is no way to eliminate the error in a business expense sheet because so many people are working on it simultaneously. Refrain from relying on spreadsheets for accuracy. Instead, invest in database software that can quickly and accurately resolve errors or flag them to you for fixing. Spreadsheet expensing requires a lot of time and work. A sales employee may have dozens of receipts to type up at the end of each month before submitting them for reimbursement.

6. Reporting is a nightmare

Managers must assemble meaningful reports based on the data in multiple versions of a business expense tracking spreadsheet compiled from various sources. Reporting from Excel can be a headache, especially when dealing with a lot of data.

7. Customer data is under attack

Be it an accident, or a raging tornado taking out your local power grid, the loss of a partitioned spreadsheet can be devastating. It’s not just Google Docs that experience data loss — Excel can go from safe and sound to wiped in the blink of an eye, too. Mainly if you use it for sensitive information, such as banking details or healthcare files.

8. No integration with a business stack

You should reconsider if manually exporting and importing your data is an excellent way to keep it in sync across various sales and marketing apps. Doing this the traditional way results in data loss, many hours spent on the back-and-forth between other systems, frustration at best... business failure at worst.

9. It's simply not made for a team management

Teams spend too much time updating and uploading spreadsheets, even with templates. Real-time data is only valuable if it's up to date. But keeping everything up to date has become a constant challenge, not just in the cloud. Still, in your ROI spreadsheets, inventory spreadsheets, CRM spreadsheets — every spreadsheet your team uses, especially bookkeeping spreadsheets for small businesses.

10. Too hard to scale

You're in the middle of a busy day, juggling a hundred projects and updating sales spreadsheets when you notice a broken formula. Everything stalls as you work to figure out what's wrong. Once you've fixed the error, you wish all these spreadsheets would talk to one another.

Are spreadsheets really that bad?

Not exactly. In some cases, spreadsheets in business can be a helpful tool:

- When you want to handle big data. If you want to see your website's traffic data quickly, a small business expense spreadsheet can help you do that.

- When you are just starting. This way, the money isn't exactly rolling in. The hustle is real. When keeping track of customers and contacts, spreadsheets are easy — and free.

- When the right tool doesn't exist. For example, spreadsheets are ideal if you work on a writing team with dispersed members and need to see your colleagues' work in one place. They also allow you to sort through your collected information and ensure accuracy quickly.

Behind all business spreadsheets' advantages and disadvantages, there are other solutions on the market.

With better tracking and reporting of finances, modern platforms can give you a fuller business picture of your company.

The next level: smart software with real-time data updates

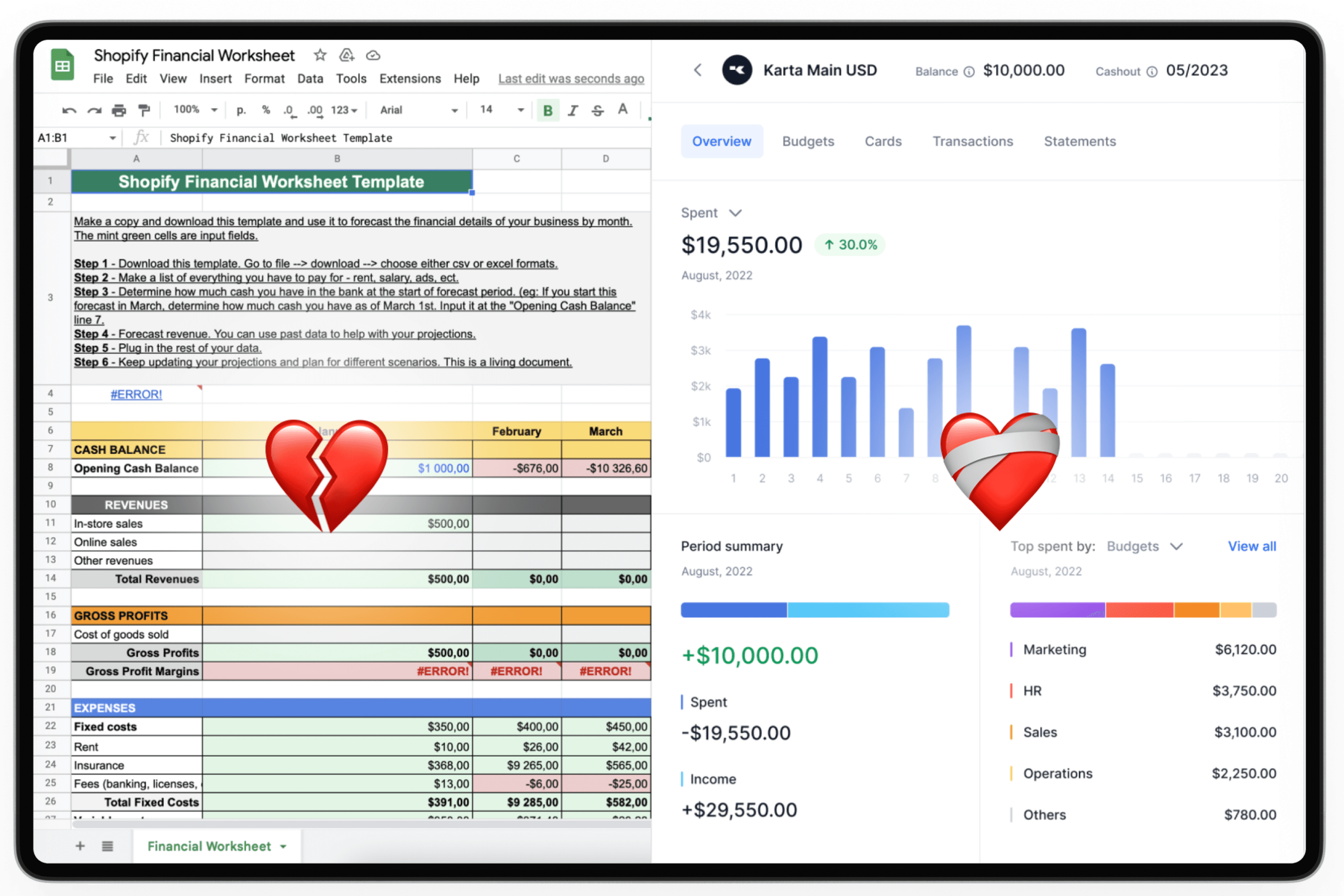

Spreadsheets for business provide excellent business insight in many areas, but the more complicated your finances become, the harder it will be to track them. You need a dependable way to manage your business expenses, and Karta's spend management software is the answer.

Create an accountOur platform lets employees create cards with built-in limits, so there's no need to save receipts and approve every expense. Finance teams can review each purchase inside one app, with fewer battles with spreadsheets and instant insights about spending.

With the Budgets feature, spending is always limited, so everyone sticks to the amount needed. This dramatically reduces the time and resources required to manage employee spending and diminishes the risks of mistakes associated with manual processes and fraud.

The bottom line? Automation rules.

Using spreadsheets in business, Karta eliminates countless hours of manual work and tedious copy-and-paste tasks. Get rid of the busy work to focus on what you do best — the business.

Get started in minutesFAQ

What spreadsheets do I need for a small business?

Our primary financial management kit includes a ledger spreadsheet, a departmental budget spreadsheet, and an annual budget spreadsheet. As your business grows, we advise you to switch to spend management software, where you get access to all expenses in real time and get budgeting tools to stay on top of project costs, manage vendors, and much more while eliminating lots-of-spreadsheet clutter.

What do companies use instead of Excel?

Businesses that want to grow need real-time expense tracking, instant access to all expenses, and easy management. They can do this with a solution that tracks and calculates expenses, exports them, and saves time on manual work. Some solutions also let you overview specific team or project costs. At Karta, you can do it with flexible budgeting tools.

Is Google Sheets good for business?

Google Sheets is an excellent tool for small businesses. But as your business grows, you have much more on the plate: scheduling, tracking expenses, staying on top of project costs, managing vendors and contractors — the list goes on. That's why spend management software is a must-have for smarter expense control.

What can I use instead of a spreadsheet?

Consider switching to spend management software with real-time expense tracking, budgeting tools, and more. You'll be able to access all your data quickly, make exports and collect together with less manual work and make faster decisions.