It can be tricky to cut through the clutter and get a clear picture of which card is right for your business. Each one is tailored for a different purpose with many types, offering various features. Business credit cards and personal credit cards are tied with credit reporting policies, credit limits, bookkeeping benefits, and consumer protections, making them more suitable for specific goals. Time to sort through them all with a crash course in credit card types so you can make an informed decision. Let the battle "business credit cards vs. personal" begin.

Business credit cards

So, what's the difference between a business credit card and a personal one? Credit cards aren't just some sort of magical portal to consumer debt. Well, yeah, they're that, but they can also benefit your day-to-day business spending. That's because credit card companies pay attention to the business owner's credit limit and the business's revenue when deciding how much money to lend. And there's more: it has bonus categories you can apply to, for example, online advertising, purchase expenses, or office supplies. Businesses can also choose to offer employee cards at no additional cost.

Personal credit cards

The biggest difference between business credit cards and personal credit cards is that personal cards are made for individuals. They're great to keep in check daily personal expenses.

Also, they have one important benefit like strong protection US law, thanks to Credit Card Accountability Responsibility and Disclosure Act of 2009 (Credit CARD Act). That means you won't have to pay outrageous late fees, be charged an APR that's changed on a whim, or get hit with fees for every little thing.

Moreover, there's a zero percent APR that deals tend to last longer and offer more generous terms for those interested in transferring balances to personal credit cards. Such offers rarely extend beyond twelve months, while zero percent APR deals for company cards rarely offer this rate for longer than a year.

But there's still an issue. While corporate cards are all-in to be shared, personal cards don't record data centrally. So business credit card vs. personal credit card is always a fight that the second one loses.

Can I use a personal credit card for business expenses?

Shortly, no. Using a personal credit card for business expenses is like playing with fire. There are many reasons you shouldn't do this, and the fact that it makes it harder to track your business expenses when tax season rolls around is one of them. So it's vital to keep business credit cards without personal credit.

Your financial records become a mess

That way, you'll leave yourself open to bookkeeping errors, not to mention that you're probably already paying enough interest on your personal card. That's why business credit cards no personal credit check should be reconsidered.

It can damage your personal credit score. Or even your business itself

Corporate structures exist to shield you from a range of possible legal problems, but if you mix your business finances with personal, you're signing up for a nightmare. If your business got sued, your personal assets could be at risk. Even your family's accounts and property could be at stake.

It leads to unhealthy dynamic with your team

When employees use their personal credit cards and get reimbursed, the company essentially becomes an interest-free loan shark. Since this isn't ideal for either party, there are better ways to handle expenses. When business credit is separated from personal credit, it's way more convenient.

Using the card for business for personal expenses: pros and cons

Putting personal expenses on a business credit card is usually not illegal, so business credit cards that do not use personal credit can occur. But there are still some issues that could arise.

- Business credit could suffer if you don't keep tabs on it;

- Tax filing becomes a pain;

- it's more complex and time-consuming;

- Some spending habits may seem fishy;

- It's harder to get a business loan;

- It can create legal complications.

The last one is probably, the hardest. Business credit card personal use is tied with a risk that your credit card company might cancel your card or impose fines if they find out that you've been making personal purchases on it. If you're juggling bills and trying to stay afloat, that's something to think about. Anyway, you should divide business credit cards and personal credit scores.

Do business credit cards affect your credit score?

The answer is "it depends" because where you stand hinges on which type of account role you're in.

Primary account holder

When opening up a business credit card as a primary account holder for a new business, you offer a personal guarantee of repayment. So if you use the card irresponsibly, it will reflect on your personal credit score. For example, if you run up a lot of debt or don't make payments on time, your personal and business credit scores will take a hit.

Authorized user

These are people added to a business credit card and are given permission to use it. Unlike the card owner, they won't be liable for any charges made on the card because their credit has not been checked.

Business credit cards can affect your personal credit, but it depends on the program and, for example, whether you're a sole proprietor or a corporation.

Why is it right to use a business credit card?

When it comes to your business finances, it's best to steer clear of credit cards with personal liability. Thankfully, there are more and better corporate cards on the market today. Business credit comes in various types, and each has its own pros and cons. However, all share many benefits that make them a better alternative to prevent a lot of headaches that come with using personal credit cards.

Improved security

With corporate cards, you can easily rely on The CARD Act of 2009,

offering a clearer terms of credit card use and a cap on fees and interest charges. While they mostly cover personal credit cards, corporate cards are also subject to them.

Divided spending

Making a habit of using a separate account for business spending will save you a lot of time, money, and peace of mind. Using business credit cards that do not report to personal credit is a no-brainer.

All-in-one management platform

Modern tech-forward companies offer more than just a new way to save: they help you discover new ways to spend less, without incentivizing spending. So it's not only a business credit cards not based on personal credit, it's a full expense management platform with tools that analyzes your company’s spending in real time and finds areas to cut costs and boost your bottom line.

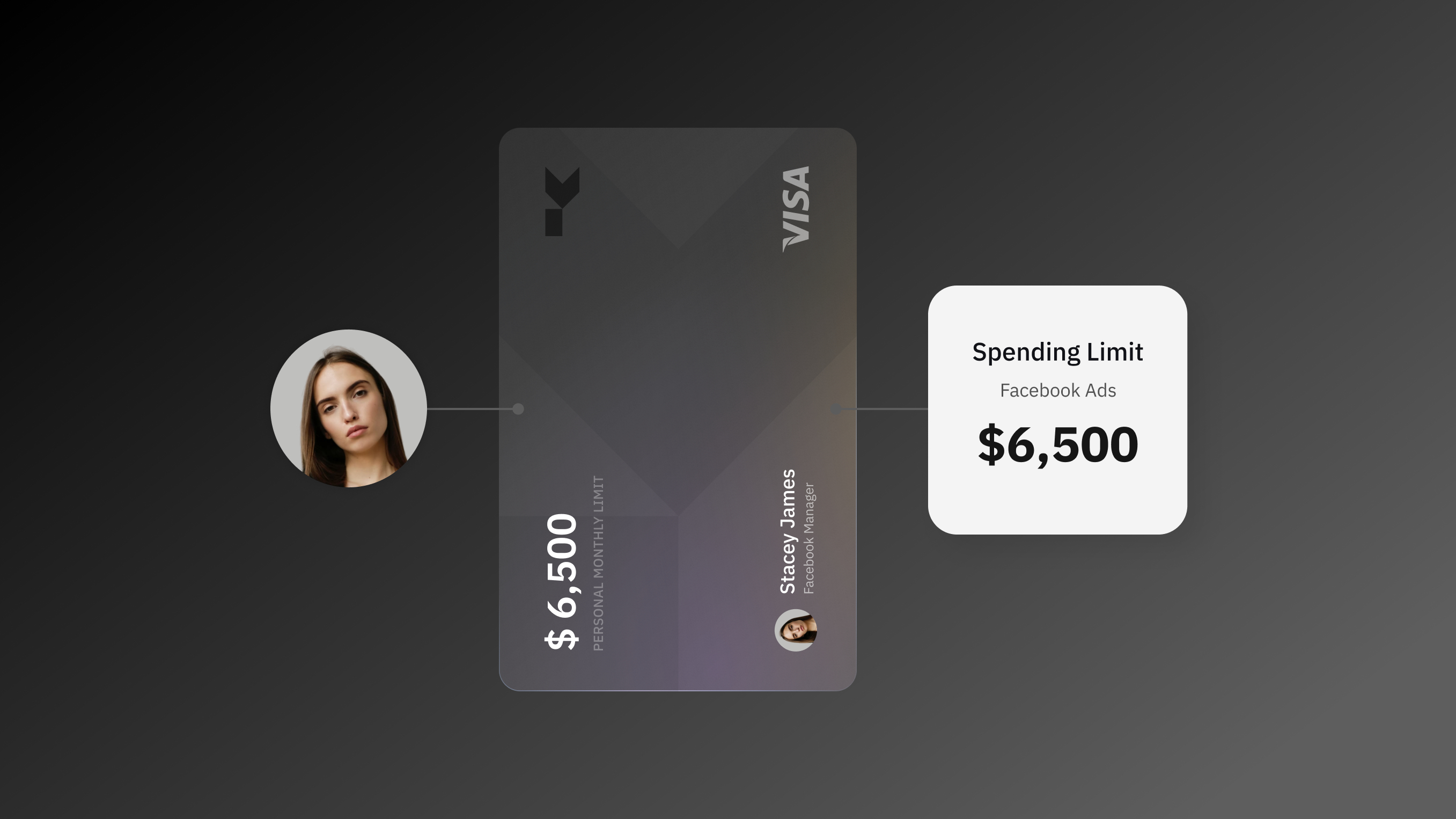

Go virtual — with cards connected to budget

KARTA's benefits for business owners and teams make our virtual cards for business a better solution than any business credit card. So it's not only about the difference between business credit and personal credit cards; it's about the bigger picture.

More about cardsIssue multiple cards inside Budgets

Depending on your goals or team size, you can create as many or as few cards as you need. Also, you can quickly freeze or block them at any minute, with no bank calls required.

Unlock the power of limits

Set a budget for each member, team, or department by day, week, or month. You set your own rules and get yourself free from overspending.

Get the real-time visibility

Easily track payments without waiting for the card statement each month. You'll never miss any dollar.

Keep your money secure

Virtual cards offer fraud protection, absolute transparency, and the power to spot duplicate payments.

The full power of smart spending is here

Get started with the all-in-one solution for your business.

Get started