While online businesses may have had the time of their lives during the pandemic (e-commerce sales increased by 43% in 2021), the political instability we're facing now punches all of us in the face without exception.

To name a few things, the latest events have caused significant supply chain disruptions, a freight price increase of over 500%, skyrocketing interest rates on business loans, and inflation likely to hit 7.5%in 2022. As if that weren't enough, we’re also seeing a drop in demand for non-essential items like designer clothing and new gadgets, which comprise about 40% of an average online business’s sales.

While intelligent resource allocation has always been a "must" for any business to stay afloat, now a strategic budget is a "can’t live without."

The bottom-up budget approach is the smartest way to plan your company’s spending so far. With a budget calculated by the people using that money, your estimates will be as accurate as possible.

So let us dive into the specifics.

What’s a bottom-up budget?

Typically, a budget is decided on at the top, based on outdated information about last year's sales or, sometimes, on the performance of your competitors. Then you shower your staff with money and sit, fingers crossed, praying for your strategy to work. (It seldom does, and this year, it probably won’t).

Bottom-up budgeting starts, well, at the bottom. The departments perform the estimates and then submitted to higher management for review and approval. This enables resource allocation that is accurate, true to life, and tailored to the business.

A budget that is calculated by the people who'll be in charge of spending it is realistic and sensible. The risk of having extra fat where you don’t want it, and a lack of funds where you do is therefore minimal.

The bottom-up budgeting approach, a.k.a. participative budgeting, implies that every employee participates in making it, thus feeling more valuable and more responsible for each dollar they spend. A bottom-up budgeting strategy makes people who spend own what they spend.

Top-down vs. bottom-up budgeting

Time to dive into the difference between top-down and bottom-up budgeting. In contrast with bottom-up budgeting, a top-down approach to budgeting is one that is based on the company's previous experience or a competitor's budget, so funds are allocated at the top. Top-down budgeting is often referred to as the "all-you-can-afford" strategy. It means you collect all the available funds and ship the bag down to your departments with little consideration of their actual needs. That's the core difference between top-down budgeting and bottom-up budgeting.

A top-down budget for advertising and promotions, for instance, would be based on a percentage of your sales in the past rather than future sales projections. The premise is that the more you spend on advertising and promotion, the more money you gain, which is a bit of a knee-slapper in today's shifting world.

Pros:

- No chance of overspending — you’ve said your word, and that’s all there’s to it.

- A single budget is easier to handle than several smaller budgets from different departments.

Cons:

- Market and technology shifts are seldom considered.

- The company's goals and objectives are not considered.

- Those at the top don’t get any critical understanding of what's going on at the bottom.

- Lower-level managers can feel disengaged and demotivated.

The bottom-up budgeting example, on the contrary, works upwards. Lower-level management estimates the budget, which is submitted to top-level management for approval. While the top-down budgeting process bases its estimations on previous experience, bottom-up budgeting is based on KPIs and objectives agreed upon by all players in the game. Needless to say, such an approach provides considerably higher accuracy levels.

Setting the budget at the bottom means that lower-level employees have a great deal of say in the process, which raises their motivation and makes the lower-lever managers own their budget instead of dumbly spending what they were told to spend.

Pros:

- Accuracy. Budgets developed at lower levels tend to be more exact and realistic.

- Raised motivation among lower-level management.

- Reduced workload for upper-level management.

Cons:

- Giving each department what they want might cost you.

- Each department's budget is calculated independently of the others—higher-level corrections might be required.

- Keeping track of all the mini-budgets requires cloud-based expense tracking software.

So, who's the winner in the "bottom-up budgeting vs. top-down" battle? All in all, if your company is tiny, a top-down budget will suffice. Bottom-up budgeting, on the other hand, is the way to go if you own a bigger business that wants a wise and accurate budget that is adaptive to current global economic trends.

How to create a bottom-up budget

To kick-off your first bottom-up budget, it’s best to follow the steps below. Use it as the bottom-up budgeting template.

1. Determine your departments

2. Encourage each department to forecast their spending.

3. Add the budgets up.

4. Review and adjust.

5. Allocate!

First things first, you'll have to segment your company's staff for a more accurate resource allocation. The most common departments in e-commerce businesses, for instance, are marketing, customer service, inventory management, and upper management. It’s entirely your call whether or not to break these departments into smaller ones. For instance, you can divide your marketing department into one that deals with social media and one that handles the rest of the advertising.

It is critical at this step to make it clear that all budgets are to be calculated in line with the company's overall KPIs and objectives. This will help you avoid the so-called budgetary slack — when the managers underestimate the revenue or overestimate the budget needed for a specific project to set goals that are easier to achieve.

Spend forecasting

As soon as you’ve identified your departments and set your key goals, it’s time to charge each department with the task of forecasting their expenses. As a result, you’ll get a comprehensive list of all the projects scheduled for the upcoming period. Using that data, you'll be able to craft a realistic plan for your company's annual or quarterly activity.

Add the budgets up

You'll get your overall budget by summing up all the forecasts your employees have submitted. At this point, the total amount may seem like more than your company can afford. That is normal and will be countered at the next step.

Review and adjust

If the budget you’ve ended up with doesn't seem sensible or realistic, go over it department by department and introduce the necessary adjustments. Bottom-up budgeting is all about communicating with your lower-level managers. Pick the departments with seemingly exaggerated budgets and negotiate whether your aims can still be met with a reduced budget.

Allocate

Phew! You’re all set to publish your budget plan, and your employees can finally start spending. Because they’ve been involved in budget forecasting, they’ll respect the limit they calculated themselves. You can now sit in the front row and contemplate your objectives being met.

However, don’t get too comfortable — at this point, you can start drawing conclusions and adapting your bottoms up budgeting strategy for the following cycle based on market trends and your company's specific spending patterns.

Budgets: our solution for seamless bottom-up budgeting

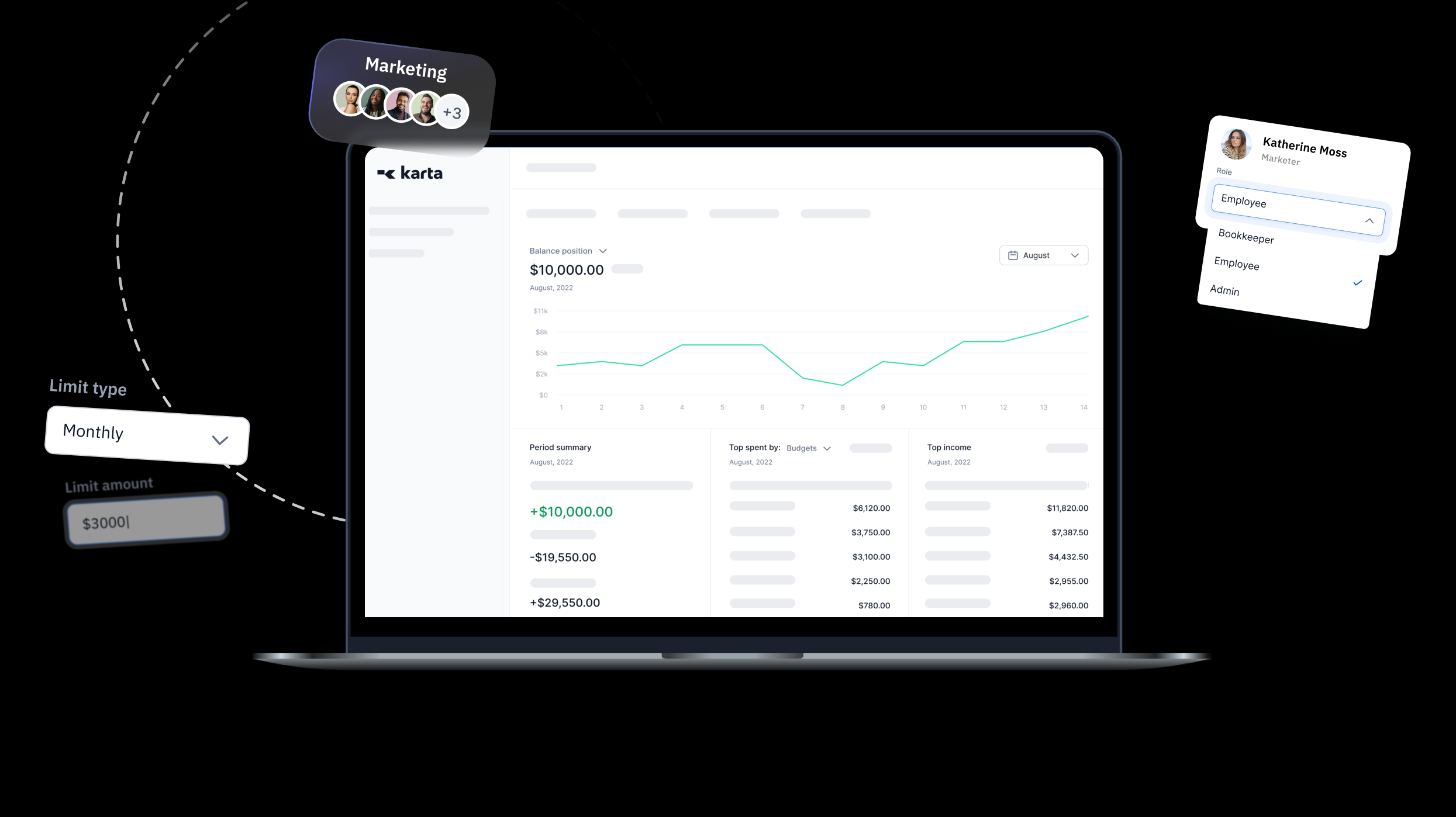

When creating a bottom-up budget, having software that’ll allow you to monitor your departments' performance instantly is key. That is precisely what we had in mind when we were working on Budgets: a cloud-based solution for multi-level budget segmentation.

Learn moreWith Budgets, you'll be able to:

- Create a budget for each team, department, or project in which multiple teams may be involved.

- Assign a manager to be in charge of budget control in each budget.

- Add new participants to a budget.

- Allow any budget member to issue virtual cards for specific purposes, lifting this burden off the managers’ shoulders.

- Ensure the total spend doesn't exceed the authorized limit; however, many cards have been issued.

- Observe what’s being spent in real time and take strategy turns at any time.

- Sort transactions by category or contractor and collect data to facilitate budget segmentation in the next round.

Robust business budgeting software is like navigation equipment for a plane flying in fog. In times of political turbulence having a dashboard that shows your company’s detailed spending in real time is crucial for making the right business decisions and root bottom-up approach to finance.