The last decade has seen radical changes in how work gets done. Cloud storage and online collaboration technologies help teams to work faster, more efficiently, and with fewer paperwork hassles.

Yet, most businesses still rely on expense management processes that have stayed the same for over 100 years.

Storing paper receipts, stacking reimbursement forms for managers and finance to review and approve, and waiting eight (or four, if you're from lucky ones) weeks for reimbursement is a huge pain in the neck.

As the finance department is responsible for most of the day-to-day operations in a company, it cracks louder. By working with information on a broad scale — both ground level and high level — the finance team keeps the business running smoothly. Financiers are the best analysts, but all the red tape often bogs down their work. Hands down, they should be catered to with more automation behind business expense tracking.

It all goes back to the old-fashioned routine

In many companies, employees still pay for their expenses and submit claims to managers, who then approve or reject the requests, so the finance team has to check every company expense. That's not right on many levels, and here are the primary layers to consider.

Employees pay out-of-pocket for expenses, scrambling to get reimbursed by the finance department

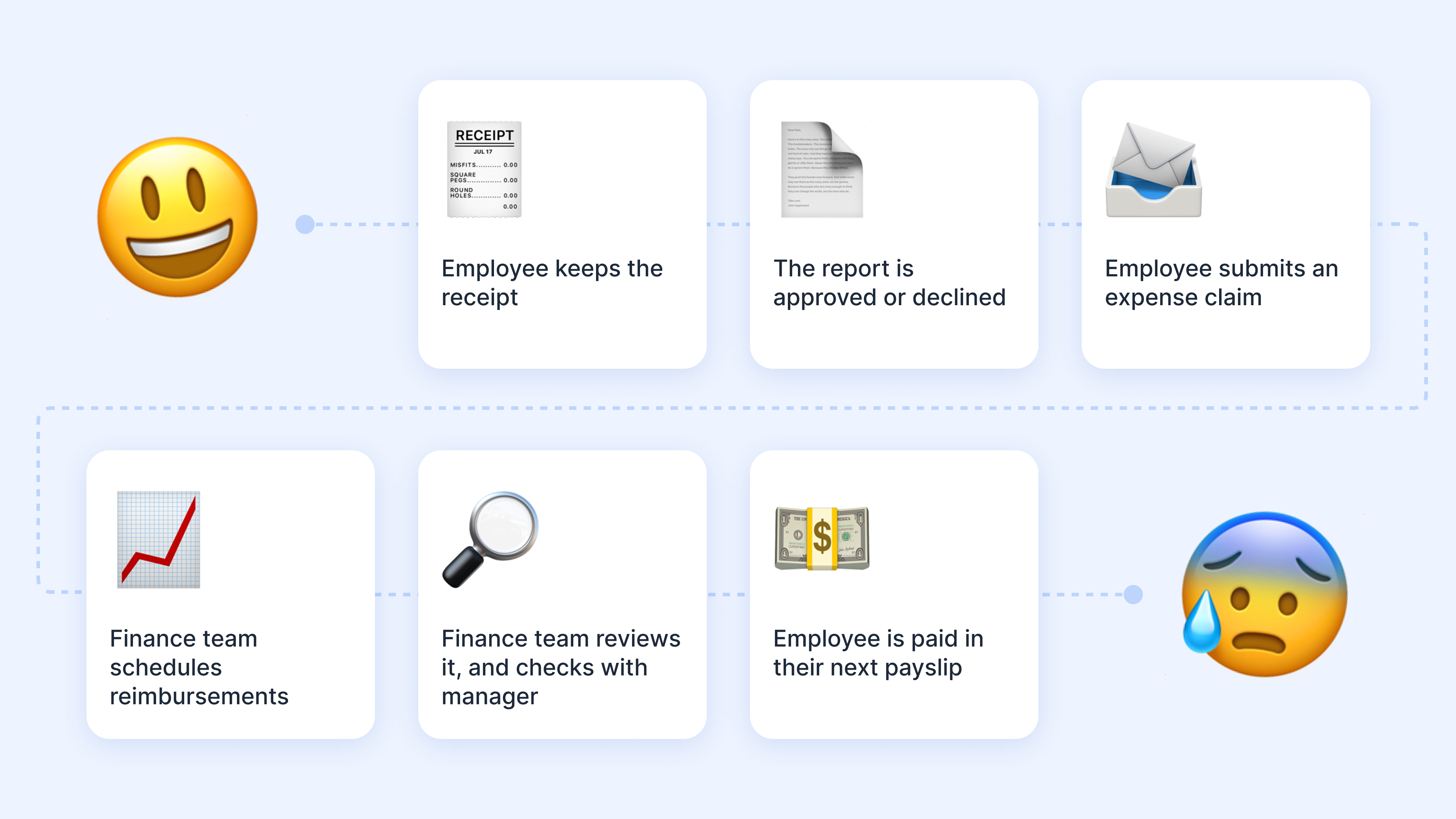

• One of your teammates pays for something with their own money. They keep the receipt if they get reimbursed at the end of the month. Fingers crossed.

• They return to their desks and wait until the end of the week or month to submit an expense claim. Before that, they double-check that they’ve followed finance’s guidelines for submitting a claim.

• Finance team reviews spending, checks with a manager that it's been approved if necessary, and enters the data into a spreadsheet. They then schedule reimbursements for team members and enter this data into their accounting software.

• Finally, the team member is paid in their next payslip. It can take months.

The processes involved are time-consuming, inconvenient, and often expensive. For that reason, many businesses rely on company cards. However, this practice has pitfalls.

The company shares one credit card while dealing with a lack of oversight

• A team member requests permission from a manager or CEO to make a purchase. The hunt for a corporate credit card is on!

• After the card is caught, an employee makes a payment, saves a receipt, and sends it to the finance team. The controller matches this to the credit card statement.

• Once the purchase is proven, the transaction is logged in the company's accounting software. Then, we go back to the fourth step from the previous part.

No transparency exists in this case: getting a corporate credit card is challenging, and communication could be better, so the financial controller knows what's been approved and by whom. Manual work for finances is required, as well as unsafe sharing of one card for all.

Invoicing customers involves a lot of manual data entry, too

• Team member seeks approval to pay the supplier for their services — by email or a quick note. The supplier sends an invoice to a team member, who forwards it to finance or procurement for processing.

• The financial controller has to check that invoices have been approved — if there is no record, it should be tracked down. The invoice details are copied into spreadsheets or entered manually into an ERP system — again, manual work.

• The controller schedules the invoice for payment, which may differ from what was agreed with the supplier. Once paid, the finance team fills in accounting tools or sends the details to an external accountant.

Here, a new problem arises. The finance department has a separate day for reconciling invoices, which is unsuitable for suppliers waiting for payment within 14 days. This causes delays and requires extra labor on the part of the financial department.

So, what's the harm to the business?

Invoices, expense reports, and credit card receipts all suffer from the same flaws — if they're not automated, the whole corporate expense management is messed up:

• One request goes through a bunch of "desks" before it's completed. Too many employees are involved in one task, and no delegation takes place.

• The financial department is overburdened. Manual tasks have become stressful for employees.

• Frustrating lack of control — essential data may be lost in paperwork.

• Rather than forecasting and strategizing, time is spent dealing with these issues.

• Security suffers, too: when employees overspend their budgets, you often don't find out until it's too late. It also increases the risk of card fraud.

Why do we put up with a complex and tedious company expense management system?

Recently, companies like Amazon, Uber, WeChat, and others have made strides in improving the user experience of personal spending technology. Why, then, haven’t we seen similar changes in business expense management? What is holding us back?

Many companies fail to realize that there are other solutions to their problems — automation, simplifying manual tasks, virtual credit cards for business, or flexible budgets. They're stuck in their old ways of doing things. Another reason is that company spend management usually falls within the purview of several levels below the CEO, and they might not even be aware of it.

While manual expense processes are inefficient and expensive, finance departments can automate their workflows to let them focus on a strategy without risking the quality of their other work. There are many areas to improve:

• Accounting and bookkeeping.

• Spend management.

• Budgeting.

• Manual checks and constant approvals.

• Invoicing customers.

• Finance strategy and forecasting.

Karta automates finance routine, streamlines business spend management, and removes the manual burden

Our solution gives you back the power to delegate and automate routine finance tasks, letting you focus on what matters most. In addition to unlimited virtual corporate cards for startups, it brings more.

Get startedThe headache of submitting claims for reimbursement is cured

You set budgets, limit them, and appoint managers to manage expenses and categories. Everything's approved, so there's no need for an additional check by the financial department. Managers know precisely when company funds are being spent and on what and why, and you're upgraded with a bird-eye view.

No more hunting for a card — each virtual credit card can be created in seconds

No more shared corporate cards. Each virtual credit card for business is tied to a project, subscription, or person, and the finance team can quickly check them all. And no approvals — limits and access rules add another point to finance team freedom.

Invoices, automated

You can send an invoice to a counterparty immediately by email, and when it's paid, you'll get the money directly into your account. The finance department can see all the data in the system, eliminating the need for reconciliations, while suppliers receive their invoices quickly.

No guesswork. Everything is clear and updated in real time

At any time of the month, everything is quickly updated. All data on expenses and virtual credit cards are in one place, and the finance team has direct access to profits and losses, knowing immediately if there are any effects from any changes.

You can get your figures quickly with automation tools and a business expense tracker. This is valuable for your business because real-time data lets decision-makers take timely action. Time to build a strategic finance function with innovative business spend management solutions.

Start todayFAQ

What is the benefit of a corporate credit card?

The finance team can set spending limits with corporate credit cards, track expenses, and monitor compliance. This helps business and personal finances remain separate and simplifies expense reporting.

What is spend management in business?

Spend management refers to businesses' processes to track, control, analyze, and optimize spending. This includes business-related items such as office supplies, software subscriptions, travel expenses, etc.

Why is business spend management important?

Spend management allows you to manage your budget wisely, eliminate wasteful spending, cut fraud, control expenses from start to finish, and gain insights into procurement that will help you make better data-driven decisions. It saves time, money, and effort.